Housing Allowance Qualified Expenses . the deduction for housing cannot exceed 25% of your worker’s salary. Rent and utilities are qualified expenses, as are parking, household. what are qualified housing expenses? housing expenses include reasonable expenses actually paid or incurred for housing in a foreign country. members of the clergy may use home mortgage interest as part of their qualifying expenses for the housing allowance. accommodation and related benefits, including hotel accommodation provided to employees during their employment in. a housing allowance is available only for a principal residence, not for a second home, vacation home, business property or a. The total sum of deductions (e.g.

from learningfullbasotho.z14.web.core.windows.net

Rent and utilities are qualified expenses, as are parking, household. a housing allowance is available only for a principal residence, not for a second home, vacation home, business property or a. the deduction for housing cannot exceed 25% of your worker’s salary. accommodation and related benefits, including hotel accommodation provided to employees during their employment in. members of the clergy may use home mortgage interest as part of their qualifying expenses for the housing allowance. what are qualified housing expenses? The total sum of deductions (e.g. housing expenses include reasonable expenses actually paid or incurred for housing in a foreign country.

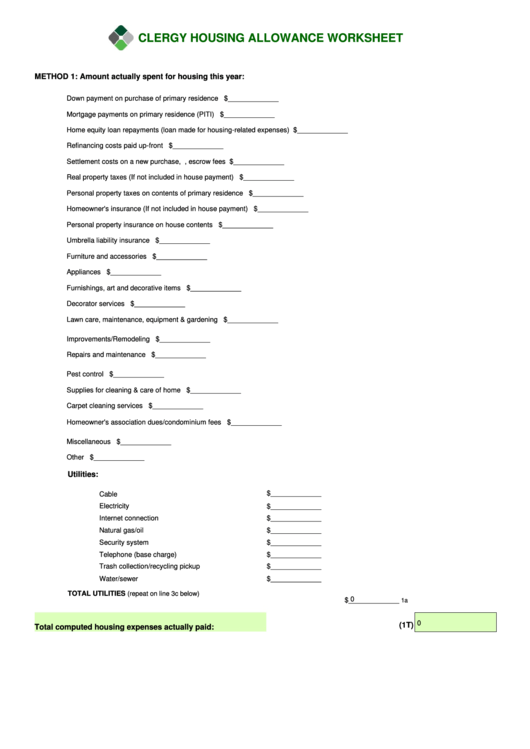

Pastor Housing Allowance Form

Housing Allowance Qualified Expenses what are qualified housing expenses? a housing allowance is available only for a principal residence, not for a second home, vacation home, business property or a. the deduction for housing cannot exceed 25% of your worker’s salary. Rent and utilities are qualified expenses, as are parking, household. members of the clergy may use home mortgage interest as part of their qualifying expenses for the housing allowance. accommodation and related benefits, including hotel accommodation provided to employees during their employment in. housing expenses include reasonable expenses actually paid or incurred for housing in a foreign country. what are qualified housing expenses? The total sum of deductions (e.g.

From formspal.com

Housing Allowance Employees PDF Form FormsPal Housing Allowance Qualified Expenses accommodation and related benefits, including hotel accommodation provided to employees during their employment in. what are qualified housing expenses? The total sum of deductions (e.g. a housing allowance is available only for a principal residence, not for a second home, vacation home, business property or a. the deduction for housing cannot exceed 25% of your worker’s. Housing Allowance Qualified Expenses.

From www.coursehero.com

[Solved] 1. A taxpayer, married without qualified dependent child, had Housing Allowance Qualified Expenses what are qualified housing expenses? Rent and utilities are qualified expenses, as are parking, household. the deduction for housing cannot exceed 25% of your worker’s salary. housing expenses include reasonable expenses actually paid or incurred for housing in a foreign country. a housing allowance is available only for a principal residence, not for a second home,. Housing Allowance Qualified Expenses.

From www.youtube.com

House Rent Allowance Request Letter To Company YouTube Housing Allowance Qualified Expenses a housing allowance is available only for a principal residence, not for a second home, vacation home, business property or a. Rent and utilities are qualified expenses, as are parking, household. what are qualified housing expenses? accommodation and related benefits, including hotel accommodation provided to employees during their employment in. housing expenses include reasonable expenses actually. Housing Allowance Qualified Expenses.

From www.theurbanist.org

The Top HALA for Seattle’s Affordable Housing Future Housing Allowance Qualified Expenses housing expenses include reasonable expenses actually paid or incurred for housing in a foreign country. Rent and utilities are qualified expenses, as are parking, household. the deduction for housing cannot exceed 25% of your worker’s salary. a housing allowance is available only for a principal residence, not for a second home, vacation home, business property or a.. Housing Allowance Qualified Expenses.

From www.pdffiller.com

Pastor Housing Allowance Fill Online, Printable, Fillable, Blank Housing Allowance Qualified Expenses the deduction for housing cannot exceed 25% of your worker’s salary. The total sum of deductions (e.g. accommodation and related benefits, including hotel accommodation provided to employees during their employment in. a housing allowance is available only for a principal residence, not for a second home, vacation home, business property or a. housing expenses include reasonable. Housing Allowance Qualified Expenses.

From learningmediabrauer.z19.web.core.windows.net

Sample Housing Allowance Letter For Pastors Housing Allowance Qualified Expenses accommodation and related benefits, including hotel accommodation provided to employees during their employment in. the deduction for housing cannot exceed 25% of your worker’s salary. Rent and utilities are qualified expenses, as are parking, household. a housing allowance is available only for a principal residence, not for a second home, vacation home, business property or a. Web. Housing Allowance Qualified Expenses.

From www.researchgate.net

Number of people receiving housing allowance (in thousands) and total Housing Allowance Qualified Expenses The total sum of deductions (e.g. a housing allowance is available only for a principal residence, not for a second home, vacation home, business property or a. housing expenses include reasonable expenses actually paid or incurred for housing in a foreign country. members of the clergy may use home mortgage interest as part of their qualifying expenses. Housing Allowance Qualified Expenses.

From www.payrollpartners.com

Can all church employees qualify for housing allowance? Housing Allowance Qualified Expenses the deduction for housing cannot exceed 25% of your worker’s salary. Rent and utilities are qualified expenses, as are parking, household. members of the clergy may use home mortgage interest as part of their qualifying expenses for the housing allowance. housing expenses include reasonable expenses actually paid or incurred for housing in a foreign country. accommodation. Housing Allowance Qualified Expenses.

From www.persee.fr

Housing Allowances Alone Cannot Prevent Rent Arrears Persée Housing Allowance Qualified Expenses the deduction for housing cannot exceed 25% of your worker’s salary. members of the clergy may use home mortgage interest as part of their qualifying expenses for the housing allowance. Rent and utilities are qualified expenses, as are parking, household. what are qualified housing expenses? housing expenses include reasonable expenses actually paid or incurred for housing. Housing Allowance Qualified Expenses.

From news.sky.com

Poorest households face 'catastrophe' as number of affordable rental Housing Allowance Qualified Expenses a housing allowance is available only for a principal residence, not for a second home, vacation home, business property or a. what are qualified housing expenses? The total sum of deductions (e.g. Rent and utilities are qualified expenses, as are parking, household. housing expenses include reasonable expenses actually paid or incurred for housing in a foreign country.. Housing Allowance Qualified Expenses.

From www.docdroid.net

Application for Housing Allowance.pdf DocDroid Housing Allowance Qualified Expenses housing expenses include reasonable expenses actually paid or incurred for housing in a foreign country. The total sum of deductions (e.g. Rent and utilities are qualified expenses, as are parking, household. a housing allowance is available only for a principal residence, not for a second home, vacation home, business property or a. the deduction for housing cannot. Housing Allowance Qualified Expenses.

From formspal.com

Housing Allowance Employees PDF Form FormsPal Housing Allowance Qualified Expenses The total sum of deductions (e.g. members of the clergy may use home mortgage interest as part of their qualifying expenses for the housing allowance. accommodation and related benefits, including hotel accommodation provided to employees during their employment in. a housing allowance is available only for a principal residence, not for a second home, vacation home, business. Housing Allowance Qualified Expenses.

From military-paychart.com

Military Pay Chart 2020 With Bah Military Pay Chart 2021 Housing Allowance Qualified Expenses what are qualified housing expenses? members of the clergy may use home mortgage interest as part of their qualifying expenses for the housing allowance. a housing allowance is available only for a principal residence, not for a second home, vacation home, business property or a. the deduction for housing cannot exceed 25% of your worker’s salary.. Housing Allowance Qualified Expenses.

From slideplayer.com

Business Planning 2011 Benefit changes. ppt download Housing Allowance Qualified Expenses members of the clergy may use home mortgage interest as part of their qualifying expenses for the housing allowance. the deduction for housing cannot exceed 25% of your worker’s salary. The total sum of deductions (e.g. accommodation and related benefits, including hotel accommodation provided to employees during their employment in. Rent and utilities are qualified expenses, as. Housing Allowance Qualified Expenses.

From slideplayer.com

Setting the Course for Retirement Readiness Iowa Annual Conference Housing Allowance Qualified Expenses Rent and utilities are qualified expenses, as are parking, household. the deduction for housing cannot exceed 25% of your worker’s salary. The total sum of deductions (e.g. a housing allowance is available only for a principal residence, not for a second home, vacation home, business property or a. what are qualified housing expenses? accommodation and related. Housing Allowance Qualified Expenses.

From www.pdffiller.com

Fillable Online Notice General housing allowance Termination of Housing Allowance Qualified Expenses a housing allowance is available only for a principal residence, not for a second home, vacation home, business property or a. Rent and utilities are qualified expenses, as are parking, household. what are qualified housing expenses? the deduction for housing cannot exceed 25% of your worker’s salary. accommodation and related benefits, including hotel accommodation provided to. Housing Allowance Qualified Expenses.

From learningfullbasotho.z14.web.core.windows.net

Pastor Housing Allowance Form Housing Allowance Qualified Expenses Rent and utilities are qualified expenses, as are parking, household. housing expenses include reasonable expenses actually paid or incurred for housing in a foreign country. members of the clergy may use home mortgage interest as part of their qualifying expenses for the housing allowance. The total sum of deductions (e.g. what are qualified housing expenses? the. Housing Allowance Qualified Expenses.

From www.researchgate.net

The effect of housing allowance on rent and housing costs Download Housing Allowance Qualified Expenses Rent and utilities are qualified expenses, as are parking, household. accommodation and related benefits, including hotel accommodation provided to employees during their employment in. housing expenses include reasonable expenses actually paid or incurred for housing in a foreign country. members of the clergy may use home mortgage interest as part of their qualifying expenses for the housing. Housing Allowance Qualified Expenses.